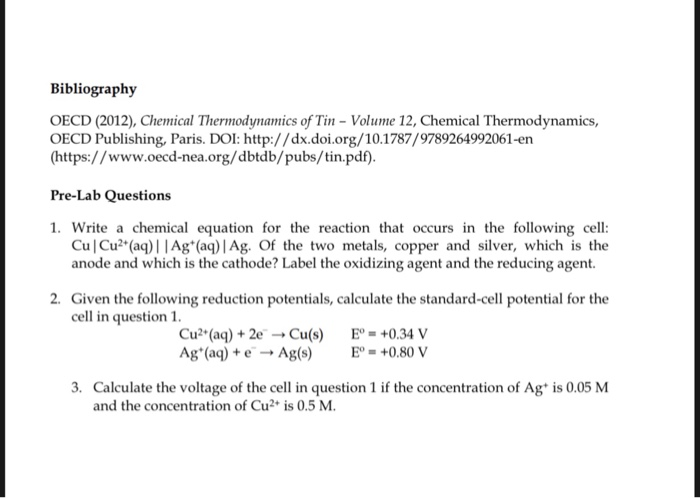

Jurisdiction's name: Switzerland Information on Tax Identification Numbers Section I – TIN Description Entities Article 2 para

![CRS, BEPS, OECD, AEOI]Q&A for Common Reporting Standard (CRS), BEPS, OECD, AEOI, etc. - HK Account Q&A CRS, BEPS, OECD, AEOI]Q&A for Common Reporting Standard (CRS), BEPS, OECD, AEOI, etc. - HK Account Q&A](http://www.hkaudit.net/image/HK%20Tax%20Tin.png)

CRS, BEPS, OECD, AEOI]Q&A for Common Reporting Standard (CRS), BEPS, OECD, AEOI, etc. - HK Account Q&A

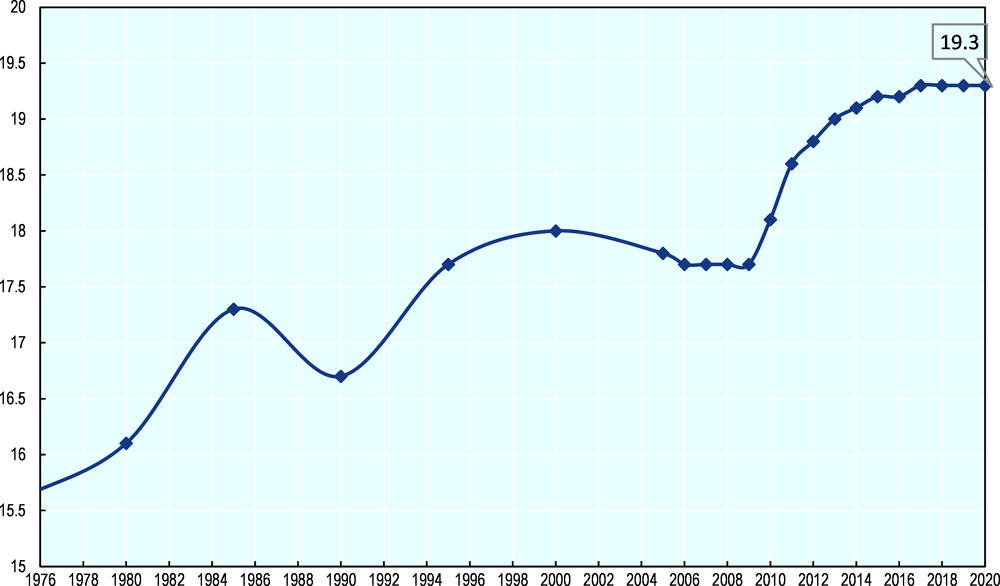

2. Value-added taxes - Main features and implementation issues | Consumption Tax Trends 2020 : VAT/GST and Excise Rates, Trends and Policy Issues | OECD iLibrary

WHAT IS THE TAX CODE? THE SECRET OF OVERSEAS BANK ACCOUNT OPENING, TAX AVOIDANCE TAX RESIDENTS CRS AND OVERSEAS BANK ACCOUNT OPENING - BPROL