Archived — Venture Capital Action Plan Performance Metrics – December 31, 2016 - SME research and statistics

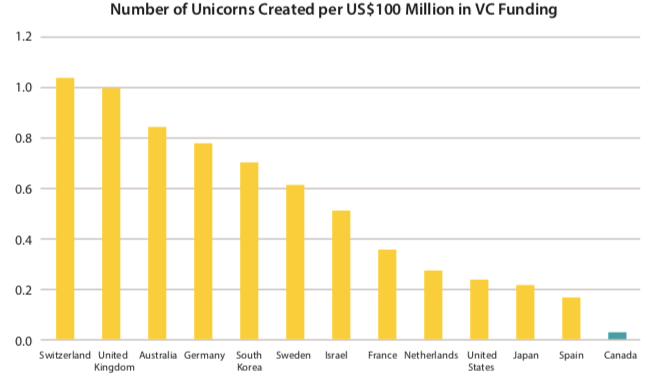

Why Canadian VC Investment Lags the US — Sampford Advisors - M&A in Ottawa, Toronto, Vancouver and Calgary

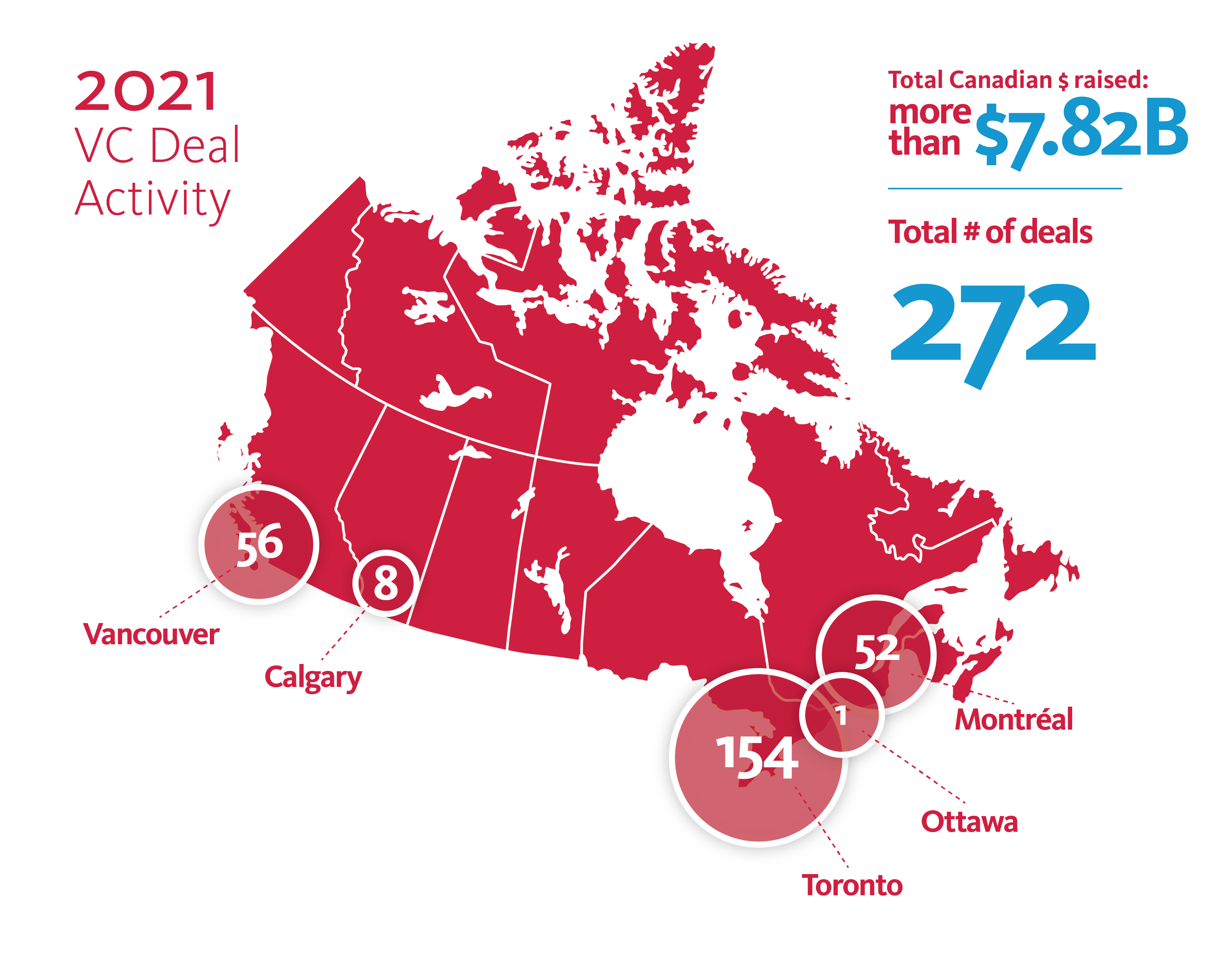

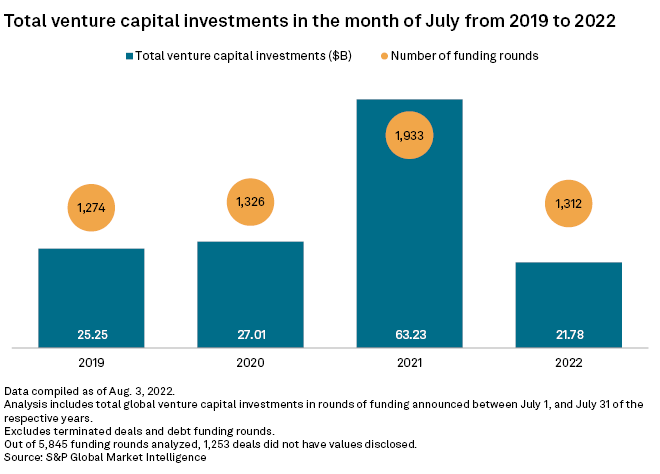

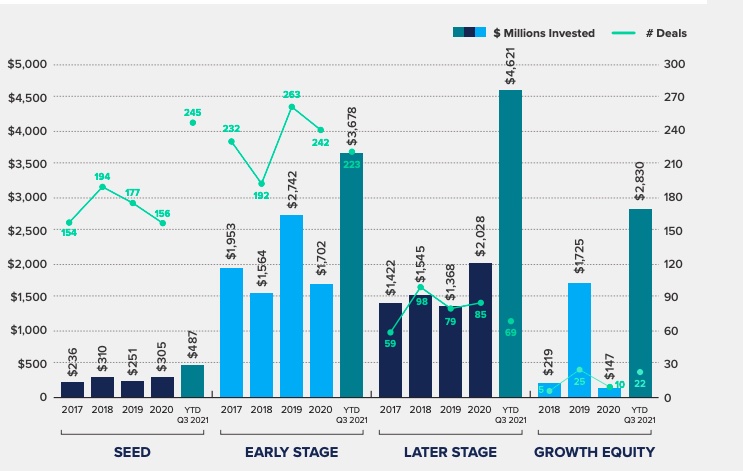

Canada sets $10.7B new VC record, driven by US VCs and Hedge funds – 1st 9 months 2021 - Private Capital Journal

Patriotic Canadian venture capital firm Inovia raises $450-million to back domestic tech champions - The Globe and Mail

![Canada's Top 20 Venture Capital Firms [2023] Canada's Top 20 Venture Capital Firms [2023]](https://sharpsheets.io/wp-content/uploads/2022/03/canadacover.webp)

/https://www.thestar.com/content/dam/thestar/business/2021/08/01/canadian-companies-seeing-venture-capital-funding-boom-interest-in-fintechs-high/20210728150756-80e868355417afb56dcd19160988d0bfb36af9186be31e1ba12d0f36d0a53be9.jpg)